Designing a New Payment Model for Oral Care in Seniors

Abstract: With 10,000 baby boomers turning 65 every day, many will be on fixed incomes and will lose dental insurance upon retirement. This article presents why a dental benefit in Medicare might save the US government money, and who would likely benefit. It details an approach to estimating costs of inclusion of a dental benefit in Medicare, and compares the proposed approach to existing proposals. Additionally, the ensuing steps needed to advance the conversation to include oral health in healthcare for the aged will be discussed.

As more of the US population reaches retirement age—led by the baby boomers—a national discussion has centered around the question of whether it is time to expand access to affordable and quality oral health services, with a growing network believing that indeed it is.1 Given mounting evidence that oral health is a part of total health and impacts the cost of care and outcomes, private healthcare insurers are reducing the overall costs of healthcare by including dental benefits in their plans for older adults.

An assessment by Optum for United Healthcare™ found that people with chronic conditions (eg, type 2 diabetes [T2D], coronary artery disease [CAD], asthma, congestive heart failure, chronic obstructive pulmonary disease [COPD], and renal diseases) who received preventive dental care saved on average $1,037 compared with people who did not receive such care. Of note was that the largest savings were in people who were not compliant with their medical care ($1,849).2 United Healthcare’s work builds on that done by Jeffcoat and colleagues3 who in 2014 studied total costs of healthcare and hospitalizations in persons with T2D, CAD, cerebral vascular disease (CVD), and rheumatoid arthritis (RA) and in pregnant women in a retrospective observational study. They found all groups with completed periodontal treatment had better outcomes and lower costs except for persons with RA. Nasseh and colleagues4 showed annual savings of $664 in healthcare costs in persons with newly diagnosed diabetes. Avalere Health LLC, at the request of Pacific Dental Services, estimated the cost savings associated with a periodontal disease treatment benefit in Medicare to be $63.5 billion over 10 years.5 The economic benefits are in addition to benefits in overall patient health and quality of life

Based on the data above and the fact that many private insurers provide dental care to capture the substantial savings from general health costs, the Santa Fe Group supports the inclusion of comprehensive dental benefits in Medicare.6,7 Given the current political climate, the potential repeal and replacement of the Affordable Care Act, coupled with the anticipated growth in number of older individuals, the disparities in access to dental care, and the prevalence of oral diseases among older adults,8-10 efforts have focused on saving cost while improving health and oral health outcomes among older adults. Importantly, there has already been a rapid expansion of the Medicare Advantage programs that include the addition of dental benefits.11 Often, though, the benefits offered under Medicare Advantage are quite limited.

The purpose of this article is to describe an approach to the development of a Medicare dental benefit, and present and compare it to other extant options with regard to how it could be developed.

Methods

Design

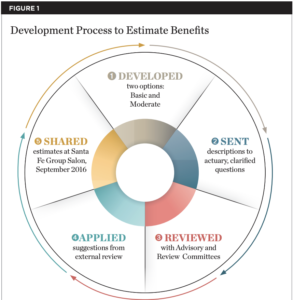

This analysis and commentary makes use of existing published data and results provided by actuarial analyses of the Fair Health® data (personal communication, Michael Monopoli, DentaQuest Foundation) to estimate costs of a dental benefit for Medicare beneficiaries. Figure 1 depicts the process used to estimate the benefits.

Sample

The Medicare population was 57 million in 2015 with total expenditures of $647.6 billion.12 Part A, for inpatient hospital and specific other medical care, covered nearly 55 million enrollees (46.3 million aged 65 and older and almost 9 million disabled enrollees) with payments of $273.4 billion in 2015.13 Part B, Supplementary Medical Insurance, provided payments for nearly 51 million people in 2015 (43 million aged 65 and older plus more than 8 million disabled enrollees), totaling $275.8 billion in 2015. Part B helps pay for physician, outpatient hospital, home health, and other services. Part C is the optional Medicare Advantage program, selected by a growing proportion of the Medicare beneficiaries that receive Parts A and B services through approved, capitated private-sector health plans. Most Medicare Advantage plans also include prescription drug coverage, which for non-Medicare Advantage plans is termed Part D. In 2015, Part D covered almost 42 million people, with benefits totaling $89.5 billion. The average monthly premium for Part D in 2017 is estimated to be $34.13

The Process of Benefit Development

The Santa Fe Group, Oral Health America, and the DentaQuest Foundation sponsored the benefit development efforts. A small Development Group, and larger Advisory and Review Groups (members are listed in the Acknowledgments) participated in face-toface and online meetings from March through September 2016. The Development Group was supported by a private actuarial firm (Milliman, us.milliman.com) to estimate premium costs on a per member per month (pmpm) and per beneficiary per month (pbpm) basis. PMPM costs are those paid per member per month for the insurance. PBPM costs are the average costs per user of the care. Because not all members use care in a given year, the PBPM costs are higher than the PMPM costs.

The Principles of Benefit Development

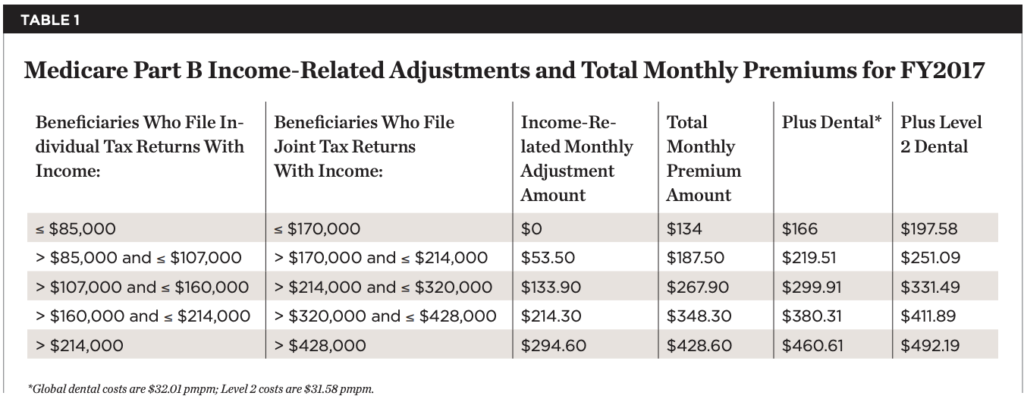

Critical requirements for the benefit were that it integrated oral health benefits into existing Medicare benefits and maintained robust oral health provider participation, and that dental benefits were available for all participants in Medicare. A focus on inclusion in Medicare Part B most closely met these requirements, given the documentation and strength of oralsystemic relationships14 and the previously described cost savings associated with access to dental care. Medicare Part B provides access to “physician, outpatient hospital, home health, and other services,” and dental care inclusion for all participants ensures access to services that would identify, treat, and prevent new sources of pain, infection, and inflammation. Part B requires all eligible people to pay a monthly premium (or have it paid on their behalf, see Table 1) that is adjusted for income.13 The income adjustment promotes health equity and social justice. Currently, older adults who are high income are 3.5 times more likely to use dental care.10 Work highlighted by the Santa Fe Group7 and the American Dental Association’s Health Policy Institute10 showed that, while older adults with high incomes were slightly more likely to use dental care between 2012-2013 (from 66.9% to 68.3%), there was a decline in the percent of low-income adults who used dental care (from 29.6% in 2010 to 19.4% in 201310). Thus, inclusion of the benefit in Medicare Part B would contribute to improved access for low-income older adults.

Procedures

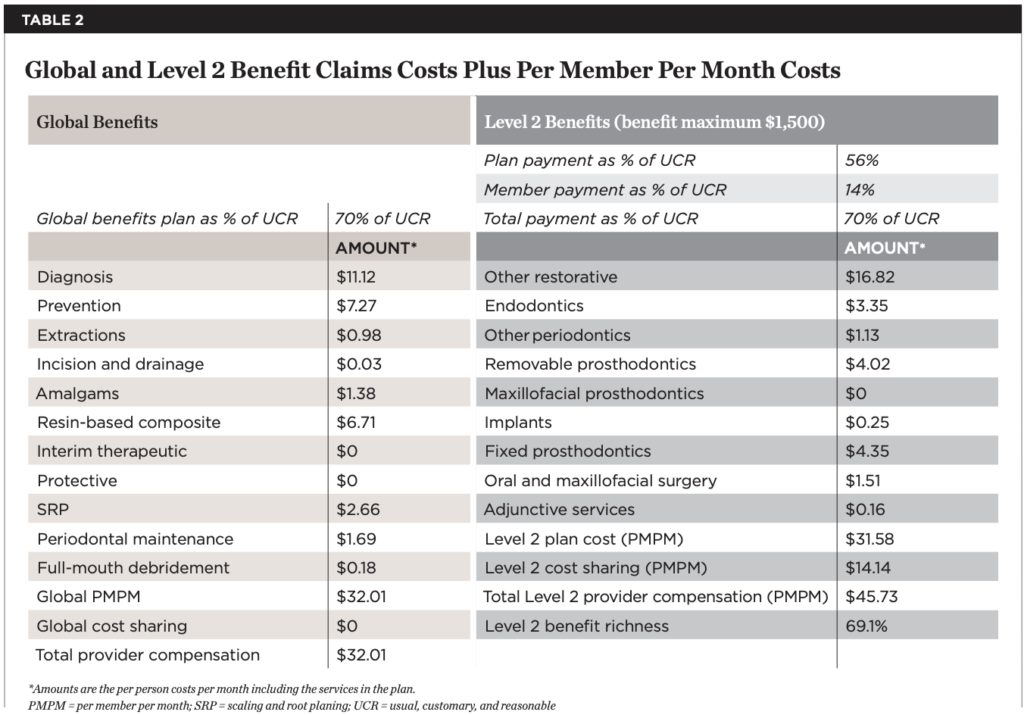

Through an iterative process (Figure 1), the authors developed options that would be acceptable to providers and beneficiaries in terms of coverage and cost. Our initial approach was to develop a “core global benefit” (Global) and a moderate, optional second-level benefit (Level 2). The primary goal of the Global benefit was to prevent pain, inflammation, and infection.14 Thus, at a minimum, the core benefit plan would provide diagnostic (Dx), preventive (Prev), nonsurgical periodontal therapy (scaling and root planing [SRP]), and non-elective oral surgery (removal of infected teeth and root tips [EXT]). The moderate, optional second-level benefit included restorative, removable, fixed, endodontic, and selected implant procedures (ie, two implants under a lower complete denture), as well as a spending cap ($1,500). Adjustments were made by the actuarial team to account for gender distribution (45% male, 55% female), utilization trends, and the impact of bundled payments by which providers would receive a periodic payment for all of the bundled services (Dx, Prev, SRP, EXTs, and direct restorative procedures). In addition, the actuarial team adjusted the estimates for intangibles like pent-up demand and pre-announcement of benefits, income adjustment (for Level 2 services only), a voluntary benefit adjustment to account for the election of the Level 2 coverage among people who expected to use it, an adjustment for non-users, and for benefit richness.

Results

Costs of providing dental care to Medicare beneficiaries are shown in Table 1 and Table 2. Table 1 shows 2017 Part B costs by income group (columns one through four) and the total costs after adding the Global and optional Level 2 dental benefits (columns five and six). Table 2 provides examples of the estimated costs of care per procedure type involved in the Global (left two columns) and Level 2 (right two columns) benefits. The actuaries estimated total annual cost of Global benefits for 37.3 million (assuming dental care use by two-thirds of the enrolled Medicare beneficiaries), with provider compensation at 70% of UCR (usual, customary, and reasonable) of $16.853 billion. Importantly, assuming the Avalere general health savings estimate5 is correct and is applied back to defer the costs of the dental program, the total cost of the program will be substantially less (eg, $12.2 billion less in year 10). In addition, these estimates do not include offsets by reducing inappropriate emergency room use. Importantly, the introduction of a dental benefit in Medicare, when balanced against the expected cost savings from improved health, is not cost neutral. This is a major concern at a time when federal spending is under great pressure.

Discussion

Understanding that Part B premiums are calculated by a formula prescribed by the 1997 Balanced Budget Act15 and tiered by the Medicare Modernization Act of 2003,16 the authors developed estimates of the cost per member per month at $32PMPM for Global benefits and $31.58PMPM for Level 2 benefits. These estimates assume no copays for Global services and a payment level to the provider of 70% of UCR. Copays were kept to $0 for Global services to remove barriers to the care needed to eliminate pain, infection, and inflammation. At the same time, our goal for provider payments was to ensure that enough providers would participate. Changes to these assumptions would change the total costs of the dental benefit for all involved.

The current approach builds on the existing Medicare structure of Part B. It would use the existing premium structure to add on an additional but not optional benefit for dental in Part B. Consistent with the critical requirements for the benefit, it is not optional, as in Part C, Medicare Advantage, where some plans include dental and some do not, or Part D, elected or not by beneficiaries. Also, note that the monthly cost for a dental benefit is less than the average monthly premium for Part D in 2017 (estimated to be $34).13

The proposed plan is both similar and different than the two policy options suggested by Willink and coworkers.17 They included income-related subsidies for premiums and cost-sharing for persons below 135% of the federal poverty level (FPL). We suggested extending the subsidies to up to 200% of the FPL, reasoning that elders on a fixed, low income would have a difficult time paying the premiums. The other main difference between the Willink et al approach and the present approach is how the benefits were estimated. We built the premiums based on the services we considered important to include. That is, we built the benefits from the ground up.

By contrast, Willink and coworkers used data from the Medicare Current Beneficiary Survey and estimated costs in two ways. Their first option was similar to Medicare Part D. It, too, was premium financed, a voluntary supplemental benefit. It fully covered one preventive visit and allowable costs up to $1,500 per person per year. They estimated that Medicare’s average spending for persons above 200% of the FPL would be $540 per person per year, and they removed 50% of the costs above a preventive care visit ($125), plus a 5% administrative fee. They estimated the average annual premium would be $29 per beneficiary per month, or $13.66 billion in premiums and that the federal government costs for dental care subsidies would be $4.38 billion per year. Their second policy option expanded dental care benefits as a core benefit under Part B, as in our plan. Here they had two suboptions. For the first, they estimated that general revenues would pay 75% of the costs and the premiums would pay 25%. Thus, the federal government share would be $14.7 billion from general revenues, and the premium per beneficiary would be $7 per month. The second suboption had general revenues covering 50% of the cost ($9.8 billion), and monthly premiums would be $15 per beneficiary per month. Thus, both of Willink et al’s estimates are the same order of magnitude but lower than the overall costs estimated by our project, ie, $16.853 billion.

Still another option would be the development of a stand-alone plan, with beneficiaries electing to buy private dental insurance on their own. The advantages are that this would be a plan available to all as an option; that is, beneficiaries would not have to elect coverage. This would incur greater costs due to adverse selection and private overhead, estimated to be well above the 5% level projected by Willink et al. Of course, there is also the potential for using an incremental expansion by which the definition of “medically necessary” dental care is expanded within the current scope of the law all the way up to full expansion for routine dental care.

Research is needed in both the public and private sectors to prospectively estimate the costs of the dental services and confirm (or refute) the cost savings seen retrospectively in the private sector as reported herein. In an era where healthcare savings are sought vigorously, this should not be insurmountable but remains so at present.

Barriers to inclusion of a dental benefit in Medicare are many. Among them are the inertia in Congress and an unwillingness to remove the exclusion of dental benefits from the initial legislation. Demands for federal dollars are highly competitive at a time when budgets are being cut and tax cuts are being considered. There is reluctance to adding an additional benefit and adapting it to the current Medicare structure. Moreover, there is a lack of political will.

In this regard, the dental profession cannot minimize the importance of advocacy-developing partnerships, as there appears to be a growing, grass-roots effort on the part of non-dental groups to add a dental benefit to Medicare. There is apparent interest among groups such as the Center for Medicare Advocacy, Gerontological Society of America, Families USA, Medicare Rights Center, and AARP. At some point, the authors look forward to a “new normal” in which dental insurance will no longer be separate, rather it will be incorporated into general health insurance plans.

Conclusion

This article describes the process used by the Santa Fe Group, Oral Health America, and the DentaQuest Foundation to estimate the costs of providing a dental benefit in Medicare. The cost estimates are compared to policy options proposed by Willink et al.17 Though this is a plausible oral health insurance benefit for Medicare-eligibles, it is highly speculative in nature. While this payment model’s reliance on a “traditional” dental benefits framework of tiered services and reimbursement via fee-for-service may be appealing to some, it is unlikely that any Medicare expansion would rely solely on such an approach. Negotiation will be required to adjust the carefully developed oral health frame of the plan to meet the regulatory and statutory requirements of Medicare.

Further research is needed to clarify and more clearly quantify the potential cost savings of providing a Medicare dental benefit. However, the benefits of including oral healthcare in Medicare to health outcomes and cost savings are now clear enough to support the need for a grass-roots advocacy effort to include oral healthcare into Medicare for baby boomers and beyond. Innovative models are needed that focus on a value-based rather than a procedure-driven model. Perhaps the next step is to examine the costs of healthcare in dual-eligible persons (those with Medicare and Medicaid) by diagnostic groups in states with and without dental care.

Acknowledgments

The authors want to thank Bianca Rogers and Beth Truett from Oral Health America and Michael Alfano and Earl Fox and all the members of the Santa Fe Group for their input and support. The Development Group included: Jean Calvo, Harvard Fellow; Jeff Chaffin, Delta Dental Iowa; Elisa Chavez, Santa Fe Group/University of the Pacific; Mary Foley, Medicaid/Medicare/CHIP Services Dental Association; Rich Manksi, University of Maryland; and Lynn Mouden, Centers for Medicare & Medicaid Services.

The Advisory Group included Jim Bramson, United Concordia; Mary Lee Conicella, Aetna; Allen Finkelstein, Dental Insurance Consultant; Harriet Komisar and Keith Lind, AARP; Mike Hegelson, Apple Tree Dental; Stacy Sanders, Medicare Rights Center; Alex White, University of North Carolina School of Global Public Health; David Lipschutz and Kata Kertesz, Center for Medicare Advocacy; David Preble and Krishna Aravamudhan, ADA; and Kiril Zaydenman, DentaQuest.

The Review Group included Stephen Abel, University of Buffalo; Georgia Burke and Jennifer Goldberg, Justice in Aging; Christopher Fox, American Association for Dental Research; Paul Glassman, University of Pacific; Ira Lamster, Columbia University; Diane Oakes, Washington Dental Service; Foti Panagakos, Oral Health America Board, Santa Fe Group, and Colgate; Colin Reusch, Children’s Dental Health Project; Grant Ritter, Brandeis University; and Damon Terzaghi, National Association of States United for Aging and Disabilities.

About the Authors:

Judith A. Jones, DDS, MPH, DScD

Professor and Associate Dean for Academic Administration, University of Detroit

Mercy School of Dentistry, Detroit, Michigan

Michael Monopoli, DMD, MPH, MS

Executive Director, DentaQuest Foundation, Boston, Massachusetts

References:

- McDonough JE. Might oral health be the next big thing? Milbank Q. 2016;94(4):720-723.

- United Healthcare. Medical Dental Integration Study. March 2013. https://www.uhc.com/content/dam/uhcdotcom/en/Private%20 Label%20Administrators/100-12683%20Bridge2Health_Study_Dental_Final.pdf. Accessed August 30, 2017.

- Jeffcoat MK, Jeffcoat RL, Gladowski PA, et al. Impact of periodontal therapy on general health: evidence from insurance data for five systemic conditions. Am J Prev Med. 2014;47(2):166-174.

- Nasseh K, Vujicic M, Glick M. The relationship between periodontal interventions and healthcare costs and utilization: evidence from an integrated dental, medical, and pharmacy commercial claims database. Health Econ. 2017;26(4):519-527.

- Avalere Health LLC. Evaluation of Cost Savings Associated with Periodontal Disease Treatment Benefit. Memo to Pacific Dental Services Foundation. January 4, 2016. http://pdsfoundation.org/downloads/Avalere_Health_Estimated_Impact_of_Medicare_Periodontal_Coverage.pdf. Accessed August 30, 2017.

- Slavkin HC, Santa Fe Group. A national imperative: oral health services in Medicare. J Am Dent Assoc. 2017;148(5):281-283.

- Chavez EM, Calvo JM, Jones JA. Dental homes for older Americans: The Santa Fe Group call for removal of the dental exclusion in Medicare. Am J Public Health. 2017;107(suppl 1):S41-S43.

- Griffin SO, Jones JA, Brunson D, et al. Burden of oral disease among older adults and implications for public health priorities. Am J Public Health. 2012;102(3):411-418.

- Calvo JM, Chavez EM, Jones JA. Financial roadblocks to oral health for older adults. Generations. 2016;40(3):85-89.

- Vujicic M, Nasseh K. Gap in dental care utilization between Medicaid and privately insured children narrows, remains large for adults. Health Policy Institute Research Brief. American Dental Association. December 2015 (Revised). http://www.ada.org/en/~/media/ADA/Science%20and%20Research/HPI/Files/HPIBrief_0915_1. Accessed August 30, 2017.

- Pope C. Supplemental benefits under Medicare Advantage. Health Affairs Blog. January 21, 2016. https://healthaffairs.org/blog/2016/01/21/supplemental-benefits-under-Medicare-Advantage/. Accessed August 30, 2017.

- Slavitt AM. Centers for Medicare and Medicaid Services. 2016 Annual Report of the Board of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds. Board of Trustees, Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds. Transmitted to Congress on June 22, 2016. Washington, DC. Page 7.

- Klees BS, Wolfe CJ, Curtis CA. Brief Summaries of Medicare and Medicaid, Title XVIII and Title XIX of the Social Security Act. November 10, 2016. Office of the Actuary, Centers for Medicare and Medicaid Services: Baltimore, MD.

- Scannapieco FA, Cantos A. Oral inflammation and infection, and chronic medical diseases: implications for the elderly. Periodontol 2000. 2016;72(1):153-175.

- H.R.2015. Balanced Budget Act of 1997. https://www.congress.gov/bill/105th-congress/house-bill/2015. Accessed August 30, 2017.

- Medicare Modernization Act Final Guidelines—Formularies: CMS Strategy for Affordable Access to Comprehensive Drug Coverage. https://www.cms.gov/Medicare/Prescription-Drug-Coverage/PrescriptionDrugCovContra/downloads/FormularyGuidance.pdf. Accessed August 30, 2017.

- Willink A, Schoen C, Davis K. Dental care and Medicare beneficiaries: access gaps, cost burdens, and policy options. Health Aff (Millwood). 2016;35(12):2241-2248.